Mortgage Pre-Approval in Canada: The Smart Buyer’s First Move

🏡 Mortgage Pre-Approval in Canada: The Smart Buyer’s First Move

Buying a home isn’t as simple as scrolling listings and booking showings. If you want to move with confidence, win offers, and avoid disappointment, you need one crucial thing first: mortgage pre-approval.

Let’s break it all down — not in stuffy banker talk, but like you and I were chatting over coffee. Because if you’re serious about buying, this is where your journey truly begins.

🤔 What Is Mortgage Pre-Approval?

Mortgage pre-approval is a lender’s written, conditional promise to loan you a specific amount for your home purchase. It’s based on your financial profile — income, debts, credit score, and down payment — and is typically valid for 90 to 120 days.

It doesn’t guarantee final approval, but it’s the strongest signal to sellers and realtors that you’re ready to go.

🔄 Pre-Approval vs. Pre-Qualification: What's the Difference?

A pre-qualification is an estimate — more like a handshake than a contract. It usually doesn’t involve a credit check or formal documents.

Pre-approval, on the other hand, involves full paperwork, a credit pull, and actual underwriting. It’s the real deal.

🎯 Why Getting Pre-Approved Matters

Let’s be honest — houses are expensive, and emotions run high when you’re buying. Pre-approval keeps you grounded and focused.

💸 It Sets Your Budget

Instead of guessing, you’ll know exactly how much you can borrow. That helps you avoid wasting time — or worse, falling in love with a home you can’t afford.

🥊 It Makes You Competitive

Sellers (and their agents) take you more seriously. In hot markets, a pre-approval can be the difference between winning and losing a bid — even over a slightly higher offer.

🔐 It Locks In Your Interest Rate

Most lenders will hold your rate for 90 to 120 days, even if rates go up. If rates drop, you get the better deal. It’s a win-win.

🧭 How the Mortgage Pre-Approval Process Works

Now that you know the “why,” let’s go over the “how.”

🏦 Step 1: Choose a Lender or Broker

A lender (like your bank) offers their own products. A mortgage broker shops the market for you, pulling options from multiple lenders — often with better terms.

📁 Step 2: Gather Your Financial Documents

You’ll need:

- Government-issued ID

- Pay stubs or proof of income

- T4s or Notices of Assessment

- Down payment confirmation

- List of debts

- Bank account statements

If you're self-employed, expect to submit 2 years of full tax returns.

✍️ Step 3: Submit Your Application

You’ll fill out a form with your income, employment, assets, debts, and consent for a credit check.

📊 Step 4: Credit Check and Ratio Analysis

Your lender pulls your credit score and checks your GDS and TDS ratios — more on that below.

📃 Step 5: Receive Your Pre-Approval Letter

If everything checks out, you’ll get a letter showing:

- Your maximum mortgage amount

- Your interest rate

- The term and conditions

- The rate hold expiration

🧠 Understanding the Stress Test

You don’t get approved based on your actual rate. Thanks to the federal government, you get stress tested — no exceptions.

⚠️ Why It Exists

The stress test ensures you can still afford your mortgage if interest rates rise. Think of it as a financial crash helmet.

📉 How It Affects Your Buying Power

You must qualify at the greater of:

- Your offered rate + 2%

- Or 5.25% (benchmark rate — may change)

So if you’re getting 4.69%, you’re qualified at 6.69%. This reduces how much you’re approved for — often by tens of thousands.

📐 Breaking Down GDS and TDS Ratios

These ratios are the backbone of mortgage underwriting. Screw them up, and your approval's toast.

💬 Gross Debt Service (GDS)

This is the % of your income spent on housing costs. These include:

- Mortgage principal and interest

- Property taxes

- Heating

- 50% of condo fees (if applicable)

GDS Formula:

(Mortgage + Property Taxes + Heating + 50% of Condo Fees) ÷ Gross Monthly Income × 100

Typical max: 39%

💳 Total Debt Service (TDS)

This includes all your debt payments, not just housing:

- Car loans

- Credit cards

- Student loans

- Lines of credit

TDS Formula:

(GDS Costs + Monthly Debt Payments) ÷ Gross Monthly Income × 100

Typical max: 44%

🔍 How the Stress Test Impacts These Ratios

Even if your actual payment is $2,200, the stress test might calculate it at $2,600 — pushing your GDS/TDS higher. That’s why people often qualify for less than they expect.

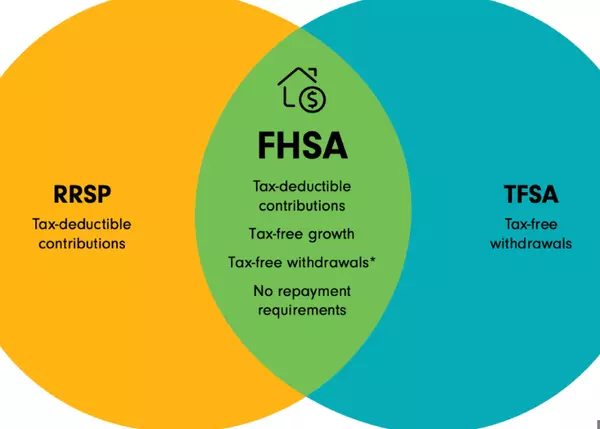

🔄 Pre-Approval for Insured vs. Uninsured Mortgages

Your down payment changes everything.

🧾 What’s the Difference?

- Insured Mortgage: Down payment under 20% → CMHC insurance required

- Uninsured Mortgage: 20% or more down → no insurance needed

📏 GDS/TDS Limits: Insured vs. Uninsured

|

Mortgage Type |

GDS Limit |

TDS Limit |

Notes |

|

Insured (<20%) |

39% |

44% |

Must follow CMHC rules |

|

Uninsured (≥20%) |

Flexible |

Flexible |

Depends on lender risk appetite |

Conventional lenders may still follow 39/44%, but private or B-lenders can stretch this — especially for strong-income borrowers or investors.

⏳ How Long Is a Pre-Approval Valid?

Most are good for 90 to 120 days. After that, you’ll need to reapply or update your documents.

❌ What Can Invalidate a Pre-Approval?

- Losing or changing jobs

- New debt (car loan, credit card)

- Missed payments

- Credit score drop

- Spending your down payment

Stay steady until your mortgage funds.

💪 Tips to Strengthen Your Pre-Approval

✅ Keep Your Credit Stable

Don’t open new cards or loans. Avoid late payments. Pay off balances when you can.

🚫 Don’t Take on New Debt

That “0% financing” on a new truck? It’ll destroy your TDS. Wait until after the keys are in hand.

💰 Save for Closing Costs and Surprises

Your down payment isn’t everything. Budget at least 1.5% of the purchase price for legal fees, land transfer tax, inspections, and emergencies.

🔚 Final Thoughts: Control the Process Before It Controls You

Getting pre-approved flips the script. Instead of reacting, you’re leading. You know what you can afford, what you can offer, and where to draw the line. In a market moving this fast, you can’t afford to be guessing.

Let the amateurs fall in love with homes they can’t afford. You? You’ll be making moves like a pro.

❓ Frequently Asked Questions

- Does getting pre-approved affect my credit score?

Yes — it involves a hard credit check, which may lower your score slightly (typically 2–5 points). It’s minimal and worth it. - Can I get pre-approved with bad credit?

It’s possible, but expect lower amounts, higher rates, or rejections from A-lenders. A broker can help find alternative lenders. - Can I make an offer on a house without pre-approval?

Technically yes — but you’ll look weak, and your offer may be ignored. In multiple-offer situations, pre-approval is essential. - Is pre-approval a guarantee I’ll get the mortgage?

No. It’s conditional. Final approval depends on the property you choose and your financial situation at that time. - Should I go with a bank or a broker for pre-approval?

A broker gives you more options and better odds of getting the best rate. A bank only offers their own product.

Categories

Recent Posts

GET MORE INFORMATION

Agent