How to Pay Off Your Mortgage Quicker in Canada

How to Pay Off Your Mortgage Quicker in Canada

Owning a home in Canada is a milestone that brings both pride and pressure. Signing the mortgage documents feels like a victory, but the thought of carrying debt for 25 years or more can feel heavy. The good news is that you do not need to stick to that full schedule. With the right strategies, you can shave years off your mortgage and save tens of thousands of dollars in interest without drastically changing your lifestyle.

Let’s break down exactly how to make it happen.

Why Canadians Want to Pay Off Mortgages Faster

There are two big reasons homeowners in Canada push to pay off their mortgage early: emotional peace of mind and financial freedom.

The emotional relief of being debt-free

Imagine waking up and knowing your home is truly yours. No monthly payments, no lender hanging over your head. That sense of ownership gives a kind of freedom no investment account can match. Many Canadians find this emotional relief is the strongest motivator.

The financial savings on interest

The average mortgage in Canada stretches over 25 years. Even at a modest interest rate, you could easily pay hundreds of thousands in interest alone. Every dollar you put toward your principal today is a dollar that will not accumulate interest tomorrow.

Understanding Your Mortgage in Canada

Before tackling payoff strategies, you need to understand the basics of how Canadian mortgages work.

Fixed vs. variable rates

A fixed-rate mortgage gives you predictable payments, while a variable rate moves with market conditions. Your payoff approach does not change dramatically between the two, but knowing your terms helps you plan effectively.

How amortization periods affect payoff speed

Most Canadians choose a 25-year amortization, but shorter periods like 20 or 15 years cut interest costs dramatically. Even if you keep the 25-year term, you can mimic shorter schedules by making extra payments.

Simple Adjustments That Save You Thousands

You do not need to double your payments to make a difference. Small changes add up.

Increase your payment frequency

Switching from monthly to accelerated schedules is one of the simplest hacks.

Bi-weekly vs. monthly payments

A monthly mortgage means 12 payments a year. Switch to accelerated bi-weekly and you will make 26 payments. That equals 13 full payments annually and shortens your amortization without much effort.

Round up your payments

If your payment is $1,242, make it $1,300. That extra $58 goes directly toward your principal. Over years, those “small” amounts make a big dent.

Make lump-sum contributions

Most lenders in Canada allow annual lump sums up to 10 to 20 percent of the original mortgage. Even a one-time $5,000 payment from a bonus or inheritance can cut months off your timeline.

Lifestyle Tweaks That Accelerate Mortgage Freedom

Your day-to-day decisions can directly fuel faster payments.

Directing bonuses and tax refunds

Instead of splurging, commit your tax refunds, work bonuses, or side hustle income directly to your mortgage. Because you were not depending on this money for bills, you will not feel like you are sacrificing.

Downsizing expenses and redirecting savings

Cutting a $100 monthly streaming bundle or eating out less might seem minor, but over a year that is $1,200. Redirecting that amount to your mortgage has a meaningful impact.

Renting out part of your home (house hacking)

Renting a basement suite, putting a spare room on Airbnb, or taking in a student tenant can turn your mortgage from a burden into a tool. Many Canadians have cut years off their mortgage by using rental income to cover part of their monthly payment.

Advanced Strategies Canadians Can Use

If you are ready to get serious, here are some more advanced approaches.

Refinancing for better terms

If interest rates drop, refinancing could lower your payments or shorten your amortization. Just make sure the penalty fees do not outweigh the benefits.

Leveraging prepayment privileges

Check your mortgage agreement closely. Many lenders let you double up a payment once a year or add lump sums without penalties. Use these privileges to your advantage.

Using accelerated bi-weekly schedules

This strategy is worth repeating because it works. Simply shifting your payment schedule can save you three to four years on a traditional mortgage.

Psychological Hacks That Keep You Motivated

Paying off a mortgage early is more about consistency than one-time efforts.

Setting milestone goals

Do not wait until the end to celebrate. Mark milestones like paying off $50,000 in principal or shaving a year off your schedule. Recognition keeps momentum going.

Visualizing your “mortgage-free date”

Put your projected payoff date on a calendar and watch it move closer as you make extra payments. Seeing progress in real time keeps motivation high.

Common Mistakes to Avoid

Getting aggressive about paying down your mortgage is good, but some mistakes can set you back.

Draining all savings to pay down mortgage

Do not empty your emergency fund. If an unexpected expense hits, you will regret having no liquid cash.

Ignoring higher-interest debt first

It makes no sense to throw money at a 5 percent mortgage if you still owe on a 20 percent credit card. Always pay off higher-interest debt first.

Forgetting about prepayment penalties

Breaking your mortgage early or paying too much too fast can trigger penalties. Always check your terms.

Balancing Mortgage Payoff With Investing

Sometimes, the smartest move is not paying off your mortgage as fast as possible.

Should you invest instead of paying down faster?

Historically, the stock market often outpaces mortgage rates. But investing comes with risk, while paying down your mortgage gives guaranteed savings.

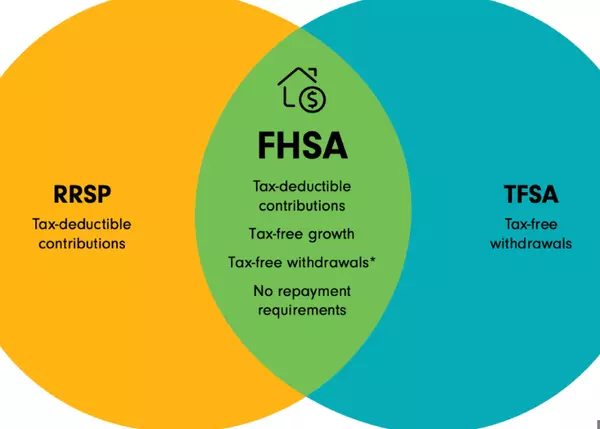

Blended approach: split between mortgage and RRSP/TFSA

A balanced strategy works well for many Canadians. Direct half your extra money into investments and half into your mortgage. That way, you are building wealth and equity at the same time.

Real-World Examples in Canada

Case study: A young couple paying off early

A Toronto couple with a combined income of $130,000 directed every bonus, tax refund, and side hustle income into their mortgage. On top of that, they switched to accelerated bi-weekly payments and added $5,000 lump sums annually. The result was shaving seven years off their mortgage.

Case study: Single homeowner balancing payoff and investing

A Vancouver teacher split her savings, contributing $400 extra per month toward her mortgage and $400 into her TFSA. She is on track to be mortgage-free by 50 while still building an investment portfolio for retirement.

Tools and Resources That Help

Mortgage calculators

Most banks and CMHC offer free online calculators. Plugging in different payment schedules shows exactly how much time and interest you can save.

Apps and budgeting software

Tools like Mint or YNAB make it easier to spot wasted spending and reallocate it to your mortgage.

Final Thoughts on Becoming Mortgage-Free

Paying off your mortgage quicker in Canada is not about massive sacrifices or six-figure salaries. It is about consistent, intentional choices. Whether you round up payments, rent out space, or refinance, every action chips away at the balance.

One day, you will make your very last payment and that freedom will be worth every adjustment you made along the way.

FAQs

Q1: What is the single fastest way to pay off a mortgage in Canada?

Switching to accelerated bi-weekly payments and making lump sums when possible is usually the most effective.

Q2: How much can lump sums reduce my mortgage?

Even $5,000 once a year can cut years off a standard 25-year mortgage.

Q3: Is it always smart to pay off a mortgage faster?

Not always. If you have high-interest debt or no emergency savings, those should come first.

Q4: Can I negotiate prepayment privileges with my lender?

Sometimes yes. Smaller lenders and credit unions may be more flexible at renewal.

Q5: Should I prioritize mortgage payoff or investing in RRSP/TFSA?

It depends on your goals and risk tolerance. A blended approach, splitting extra money between the two, is often the most balanced strategy.

Categories

Recent Posts

GET MORE INFORMATION

Agent