Step-By-Step Guide To Buying Your First Home

🔑 Introduction: Why Buying Your First Home Matters

Buying your first home is a milestone that combines excitement, responsibility, and investment all rolled into one. It’s more than just owning property — it's about planting roots and building wealth over time.

But with so many moving parts, how do you actually go about it without losing your mind? That’s what we’re here to break down: simple, clear, and step-by-step.

💸 Step 1: Understand Your Financial Readiness

📊 Assess Your Income and Expenses

Buying a home isn’t just about affording the mortgage payment. You need to look at your entire financial picture: income, debts, spending habits, and savings.

Think of your budget as your home's foundation — the stronger it is, the better everything else holds up.

Use a budgeting app or a simple spreadsheet to track every dollar — you might be shocked where your money actually goes!

📈 Check and Strengthen Your Credit Score

Your credit score is like your real estate "report card" to lenders. A higher score means better rates and more approval options.

If your score isn’t where you want it to be, start by paying off credit cards, keeping balances low, and making payments on time.

It's the financial version of cleaning up your room before inviting important guests over.

💰 Step 2: Save for Your Down Payment and Closing Costs

🏦 Minimum Down Payment Requirements Explained

In Canada, your minimum down payment depends on the price:

- Under $500,000 → 5% minimum

- $500,000–$999,999 → 5% on the first $500,000 + 10% on the rest

- Over $1,500,000 → 20% minimum (no mortgage insurance available)

The more you put down, the less you borrow — and the less interest you’ll pay.

Think of it like buying a pizza: the bigger slice you pay for upfront, the less you owe later.

📑 Estimating Closing Costs

Beyond your down payment, closing costs typically range from 1.5% to 4% of the purchase price.

These include legal fees, land title transfer fees, home inspections, and moving expenses.

Always budget a little extra — because the unexpected loves to show up when you least expect it.

📝 Step 3: Get Pre-Approved for a Mortgage

🔍 Pre-Approval vs. Pre-Qualification

Pre-qualification is like being told, "You could probably afford this much."

Pre-approval is like a bank shaking your hand and saying, "We’re ready when you are."

Always aim for a formal pre-approval — it locks in your rate for up to 120 days and strengthens your offers with sellers.

🤝 Step 4: Partner With a Trusted Realtor

A good Realtor is more than a tour guide. They’re your advocate, negotiator, market expert, and safety net.

And best of all? As a buyer, you usually don't even pay them — the seller does.

Pick someone who listens more than they talk — it makes a huge difference.

🏘️ Step 5: Start Your Home Search

🧾 Determine Your Needs vs. Wants

Before you scroll through a million listings, get clear:

- Needs = Dealbreakers (e.g., number of bedrooms, commute time)

- Wants = Nice extras (e.g., updated kitchen, big backyard)

Stay focused. It’s easy to fall for a pretty kitchen and forget about a brutal 40-minute commute.

🌎 Understand Different Neighborhoods

Every area has a personality. Some are buzzing and young (think Riversdale), others are quiet and suburban (think Rosewood).

Spend time walking around neighborhoods at different times of the day to feel the real vibe.

📜 Step 6: Make a Smart Offer

🛎️ Key Parts of a Purchase Offer

An offer isn’t just about the price. It includes:

- Deposit amount (shows seriousness)

- Conditions (financing, home inspection, sale of buyer’s home)

- Possession date

- Inclusions (appliances, blinds, fixtures)

Lean on your Realtor’s advice to structure an offer that wins without throwing your wallet at the wall.

Sometimes it’s not about the highest offer — it’s about being the cleanest and most confident.

🔍 Step 7: Conduct Home Inspection and Appraisal

After offer acceptance, you'll want two key checkpoints:

- A home inspection to catch hidden issues (think foundation cracks, mold, wiring).

- A lender appraisal to confirm the home’s value supports your mortgage.

If problems pop up, you can renegotiate—or safely back out if you included the right conditions.

✅ Step 8: Finalize Your Mortgage

Once your inspection and appraisal are green-lit, your lender will finalize the mortgage documents.

You’ll sign a mortgage commitment, locking in your rate, term, and payment.

Pro tip: Read every line carefully — once you close, you’re locked in.

🏡 Step 9: Closing Day Preparation

In the weeks before possession, your real estate lawyer will:

- Conduct the title search

- Adjust property taxes and utilities

- Register your mortgage and title transfer

You'll also set up utilities and arrange home insurance.

On closing day, your lawyer transfers funds to the seller — and you get the keys!

🎉 Step 10: Move-In and Celebrate

Congratulations — you’re officially a homeowner!

Whether it’s pizza on the floor, or hosting a massive housewarming, celebrate this major milestone.

You didn’t just buy a house — you built a future.

⚠️ Common First-Time Buyer Mistakes to Avoid

- Overstretching budget.

- Skipping the home inspection.

- Getting emotional and overpaying.

- Forgetting about property taxes and maintenance costs.

Remember: Your goal isn’t just to buy a home — it’s to keep it comfortably.

🚀 Final Thoughts: Ready to Make Your Move?

Buying your first home can feel overwhelming — but it doesn’t have to be.

With the right preparation, a great Realtor, and a solid plan, you'll go from house hunting to housewarming in no time.

If you’re ready to take the first step, reach out — I’d be honored to guide you through the process!

❓ FAQs About Buying Your First Home

Q1: How much should I budget for closing costs?

Plan for 1.5%–4% of your purchase price for legal fees, inspections, and taxes.

Q2: What’s the difference between a deposit and a down payment?

The deposit is part of the down payment, paid upfront to show you're serious. The down payment is the full cash amount you contribute.

Q3: Do I need mortgage insurance?

If your down payment is under 20%, yes. It protects the lender but adds cost to your mortgage.

Q4: How long does the home buying process take?

Typically 30 to 90 days from offer to moving in, depending on financing and conditions.

Q5: Can I buy a home with zero down payment?

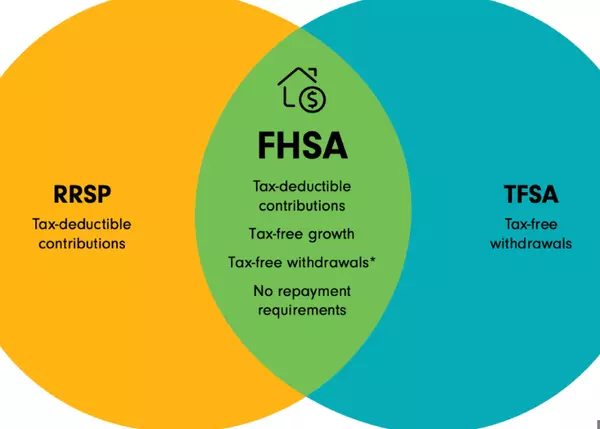

Rare, but possible using programs like the RRSP Home Buyers' Plan or gifted funds. Still, having at least 5% saved is smart.Categories

Recent Posts

GET MORE INFORMATION

Agent