Common Mistakes First-Time Homebuyers Make

Common Mistakes First-Time Homebuyers Make

Introduction

Buying your first home is exciting, but it’s also a major financial commitment—and it’s easy to make costly mistakes if you're not prepared. This guide outlines the most common pitfalls first-time buyers face in Saskatchewan and how to avoid them.

1. Not Getting Pre-Approved First

Many buyers start home shopping before talking to a lender. Without pre-approval, you risk falling in love with homes outside your budget—or missing out on competitive offers because your financing isn’t locked in.

2. Underestimating Total Costs

Buying a home involves more than the down payment. Common overlooked expenses include:

- Legal fees

- Property tax adjustments

- Home inspections

- Utility hookups

- Home insurance

- Moving costs Always budget for at least 1.5%–2.5% of the purchase price in closing costs.

3. Not Understanding Mortgage Options

Choosing the wrong mortgage term or interest rate type (fixed vs. variable) can cost you thousands. A mortgage broker or advisor can help compare options based on your goals.

4. Skipping the Home Inspection

Trying to save money by skipping the inspection is risky. Inspections uncover hidden issues like foundation problems, electrical hazards, or moisture damage that could lead to major expenses down the line.

5. Focusing Only on Aesthetics

Don’t get blinded by granite countertops or trendy staging. Focus on fundamentals:

- Layout and space

- Roof, furnace, and windows

- Plumbing and electrical

- Location and resale potential

6. Not Factoring in Future Life Changes

Will this home still work for you if your job changes, your family grows, or interest rates rise? Think long-term—not just for today.

7. Overextending Financially

Just because you're approved for a certain amount doesn’t mean you should spend it all. Leave room in your budget for unexpected expenses and a comfortable lifestyle.

8. Ignoring the Neighbourhood

A great house in the wrong location is a bad buy. Visit at different times of day, talk to neighbours, and research crime rates, schools, and future developments.

9. Making Emotional Decisions

In a competitive market, it's easy to get swept up in bidding wars. Stick to your budget and your must-haves. Don’t let emotion overrule strategy.

10. Not Using a Buyer’s Agent

Some first-timers think they’ll save money by going directly to the listing agent. In reality, having your own Realtor costs you nothing and gives you protection, negotiation power, and inside-market advice.

Conclusion

First-time homebuying doesn’t have to be overwhelming. Avoiding these common mistakes can save you money, stress, and regret—and help you make one of the smartest investments of your life.

FAQs

Q1: How much do I need for a down payment in Saskatchewan?

A: Typically 5% of the purchase price for homes under $500,000, but the more you put down, the less you’ll pay in interest and mortgage insurance.

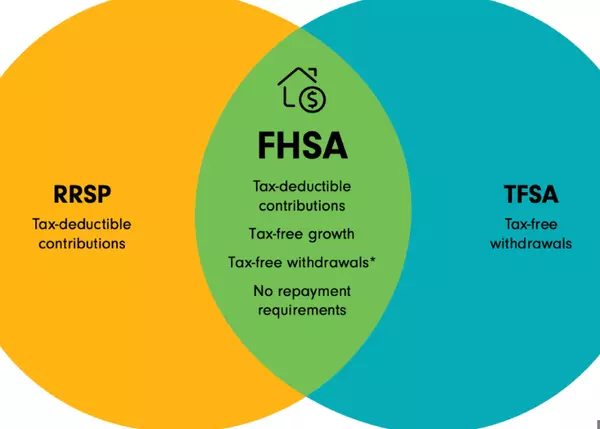

Q2: Can I use my RRSP to help with my first home?

A: Yes. Through the Home Buyers’ Plan (HBP), you can withdraw up to $60,000 tax-free from your RRSP to use as a down payment.

Q3: Should I buy a condo or a house?

A: Depends on your lifestyle, budget, and long-term goals. Condos may have lower prices but come with monthly fees and different responsibilities.

Q4: What’s the difference between pre-qualified and pre-approved?

A: Pre-qualification is an estimate. Pre-approval means a lender has reviewed your finances and is ready to lend you a specific amount.

A: A Realtor can help you understand current market conditions, interest rates, and local trends so you can make an informed decision.

Categories

Recent Posts

GET MORE INFORMATION

Agent